Retirement Investment

Risk Assessment

Clearwater and Tampa Bay Florida

RISK ASSESMENT & MANAGEMENT

Risk during retirement isn't necessarily a bad thing. However, why take risk in retirement if it isn't needed?

Many people are aware of the connection between risk and reward. However, not everyone understands how to define risk or what level of risk is appropriate for them. We help people understand their current financial risk level. We also help align their risk level with the financial future they intend to enjoy.

RETIREMENT INVESTMENT RISK ASSESSMENT

Understanding the risks associated with your investments and aligning the risk with goals.

Determining Risk Tolerance

One of the first steps in our retirement planning process is to determine your risk tolerance. Through short questionnaires and conversations, we help our clients understand the level of risk they are comfortable with.

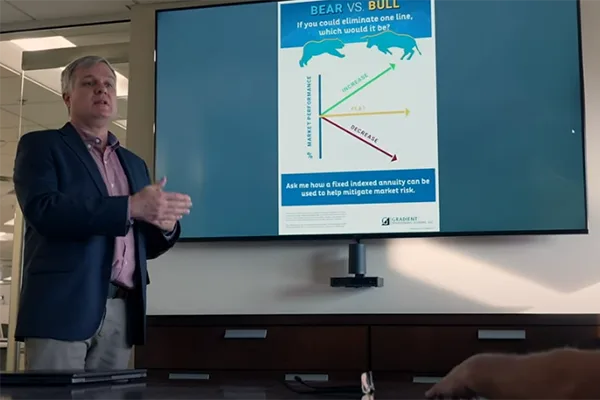

Simplifying Risk Discussions

Everyone has a different definition for what is risky and safe. We provide a simple color-coded risk level chart which ranges from Green (relative safety) to Yellow (managed risk) to Red (high risk). By categorizing a client’s existing assets by these colors, it’s easier to visualize the current risk level.

Retirement, Color of Money

Discussion on the risks associated with investing and how to categorize risk in a simple color-coded way.

RISK ASSESSMENT

Risk Tolerance

To determine your general risk tolerance, we start with a simple 11 question survey. Your Risk Tolerance score is in a range between 0 (least tolerance for risk) and 100 (most risk tolerance).

Current Risk Level

We analyze your current assets and determine the risk associated with those assets. Your assets are shown in a color-coded pie chart for an quick glimpse of the level of risk you are taking with your assets.

Reality vs. Expectations

Once you know your risk tolerance and your assets are categorized by risk level, you can begin to see the differences between how you feel and how you are invested. Oftentimes, there is a big disconnect between how people are invested and the level of risk they are comfortable with.

Color of Money Risk Analysis

Knowing the difference between the level of risk you are taking with your investments and the actual level of risk you can tolerate is very enlightening.

Start by finding our your very own Risk Tolerance score with this short survey.

Free Financial Education - Dolphin Financial Videos

Explore our comprehensive video library dedicated to Investment Risk Assessment.

QUESTIONS YOU ASK & PROBLEMS WE SOLVE:

How much risk should I take in order to meet my retirement goals?

Our philosophy as retirement planners is to minimize the risks whenever possible. While some level of risk is to be expected within a retirement plan, our goal is to keep that risk to a minimum while still achieving the retirement goals.

What is "risky" and what is "safe"?

We use a simple definition of safe to mean any investment that can not go down in value (outside of inflation). If it can go down in value, then it is risky.

Is there a way to keep risk low while still generating reasonable returns?

There is usual a direct correlation between risk and return – the higher the return, the higher the risk. However, there are ways to generate returns that are appropriate for the level of risk associated with that investment. As fiduciaries, we are open to all options that are in the best interest of our clients.

I can't tolerate any risk. Is there a solution for me that is realistic?

There are many asset classes that have little risk associated with them. However, they often yield lower returns than their riskier counterparts. We strive to find a balance between risk and return and have successfully created realistic retirement plans for clients who have zero tolerance for risk.

Can I live through my retirement without financial risks?

There are always financial risks in retirement as most things in life do have a financial impact in some way. While we are not able to eliminate all financial risks for our clients, we do strive to keep financial risks to a minimum by designing comprehensive retirement plans.