Financial Services

Creating inflation-adjusted income streams to last through the entire retirement.

The core of our business is creating inflation-adjusted income streams to last through your entire retirement. All too often people get caught up in the amount of assets they have rather than the level of income those assets can generate.

Health insurance, Medicare, life insurance, and Long-term Care strategies.

Insurance is a big part of retirement planning. Whether it is to protect your health, your life, or your assets, insurance tools may be needed.

Retirement is so much easier if you have a plan.

We focus on planning for and living in retirement. We not only design comprehensive retirement plans, but help to implement and adjust those plans over time.

Active and passive management strategies for your investments.

There are many ways to invest your retirement nest egg. Everyone’s situation dictates a different approach. We help align your situation with a solid investment plan.

Retirement might last 20, 30, or 40 years! Retirement plans that consider your longevity.

There are many factors to consider when planning for such a long period of time. We help to build plans that include issues surrounding aging in retirement which go beyond traditional money management.

Getting the most out of Social Security makes financial sense.

Social Security is far more complicated than most people realize. We provide innovative strategies for maximizing your benefits.

There is a big difference between preparing your taxes and planning your taxes.

Perhaps the most impactful piece of retirement planning is determining your current and future tax liability and developing strategies to minimize the amount of taxes you pay in retirement.

Leaving behind assets for future generations in a strategic, tax-efficient manner.

Creating an optimal strategy for your estate to maximize how much you leave behind, while still ensuring that your financial needs are taken care of for the rest of your life.

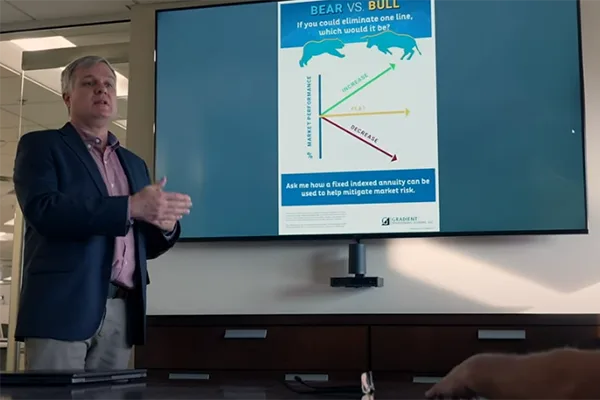

Why take risk in retirement if it isn't needed?

Many people are aware of the connection between risk and reward. We help people understand their current financial risk level and align it with the financial future they intend to enjoy.