Retirement Planning

Blog

Financial Education Blog: Retirement Planning, Investing, & Tax Tips

Planning for retirement doesn’t have to be overwhelming. At Dolphin Financial, we’re here to simplify the process with expert insights and actionable advice. Our retirement planning blog covers everything you need to know to prepare for your future, from maximizing your Social Security benefits to building a sustainable income strategy and understanding tax-efficient savings options. Whether you’re nearing retirement or just starting to plan, our articles are designed to help you make informed decisions for a secure and comfortable future.

Retiring To Florida – Tips From Experience

Executive Summary: What\’s it like to relocate to Florida for retirement? What are some of the issues you\’ll face making this move? In this episode we talk with Dennis, who recently moved from Minnesota to retire in Florida. Get his

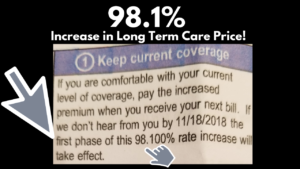

Increasing Costs Of Long Term Care

Executive Summary: Long Term Care expenses are high and seem to be increasing each year. It\’s an expense that is difficult to deal with, and certainly not a fun topic of discussion. However, some people have bought LTC insurance. In

Social Security: Marriage, Death, & Divorce

Executive Summary: What happens to my Social Security when:I lose my spouse?I get divorced?My ex-spouse dies?I get remarried?Can I claim against an ex-spouse and will they know?What will my benefit be?Do I have to wait until 62?What can I do

Student Loan Crisis Tips & Strategies

Executive Summary: The student loan situation has reached crisis levels. It has become a 2020 campaign issue. In this show we talk about student loans. We discuss the causes and how to deal with it. And, after some differing opinions,

Should I Buy A New or Used Car?

Executive Summary: Don\’t buy a new car! In this show we analyze an article that suggests spending no more than 10% of your gross income on a car. For many people, 10% isn\’t enough to buy a new car. Therefore,

The Social Security Scam

Executive Summary Is Social Security itself a scam? Have you been contacted by a scam artist claiming to be from Social Security? In this show we will discuss both of these seemingly related topics. We will talk about the newest

My Universal Life Policy Is Failing

If you own a Universal Life Policy, there is a possibility that the policy is not doing what you had intended. Even worse, the policy may be imploding on you. In a previous article “Universal Life Insurance – A Ticking Time Bomb” I

Florida Wills, Trusts, and Estate Planning Basics

Summary: Do I need a Will if I have a Trust? Do I need to update my Will if I move to Florida? Do I really need any of these documents? What\’s the bare minimum I can get away with?

Should I Do A Roth Conversion? Impact Of The SECURE Act.

Summary: With the passage of the SECURE Act and the changes to IRA rules, discussion on Roth conversions is heating up. In this show we will talk about why Roth conversions are a hot topic now and also why they

How To Avoid Taxes On Capital Gains

Summary: Capital gains are a good thing. You made a profit on an investment. However, the IRS wants to tax those gains. In this show we talk about the different types of capital gains and provide specifics on how to