INVESTMENT MANAGEMENT

Clearwater and Tampa Bay Florida

Active and passive management strategies for your investments

There are many ways to invest your retirement nest egg. You must carefully consider the risks and the rewards.

We offer several styles of investment management: passive, aggressive, conservative, robotic, active, etc.. Everyone's situation dictates a different approach. We help align your situation with a solid investment plan.

Investment Management Strategies

Managing Investment Behavior

Many investment plans fail due to poor decisions made during emotionally charged situations. Part of our job when implementating investment plans is to maintain an objective stance during all market situations. We attempt to improve returns by acting as a barrier between our clients' investments and detrimental emotions and behaviors.

Locking In Stock Market Gains

Investors are notorious at failing when trying to correctly time the market. In this video we discuss when and how to lock in stock market gains.

QUESTIONS AND PROBLEMS WE SOLVE:

Which Investment Is Best?

There is a debate between which provides higher returns - active or passive, robo or traditional, etc.. The answer is that it depends on your situation. We utilize different money managers that best meet your desires and needs.

What level of risk is appropriate to generate the returns I want?

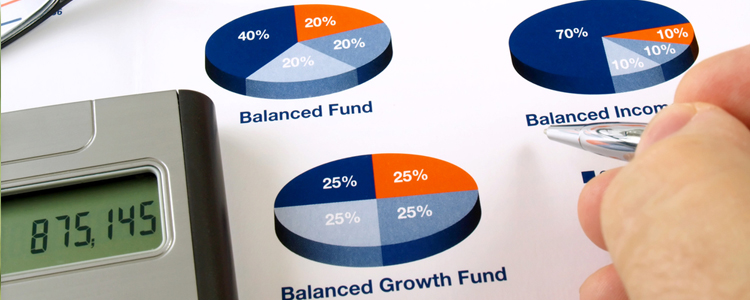

The goal of investing is often to increase returns. Usually higher returns are associated with a higher level of risk. We provide options to invest in portfolios which aim for higher returns, but these same portfolios come with additional risk. Therefore, we work with clients to determine what level of risk/return is appropriate. We employ several tools to help people determine their risk level and then provide constant oversight of that risk tolerance through the market ups and downs.

Where can I find enough returns to live off my interest only?

Some investors want income, but do not want to touch any of their principal. This is where the interest gained on this principal compared to the risk of that pool of money is critical. For those that do not want to lose any principal, fixed instruments like CDs and Fixed Annuities are often used. For those willing to risk the movement of their principal balance, bonds and dividend paying stocks can provide higher returns.

What types of investments do you use and recommend?

Investment management is heavily focused on managing risk and desired return or income. As a fiduciary, we must provide access to the tools that are in our clients' best interests. Therefore, we are open to using any tool that is not only suitable, but also most appropriate for each situation. Investment tools, products, and options that we use include, but are not limited to: Stocks, Bonds, REITs, Annuities, CDs, and ETFs. We work closely with retirees to help them stay on the track to optimal retirement so that they live their desired lifestyles during some of the best years of their lives.

CUSTOMIZED INVESTMENT PLAN

Investment plans with a focus on retirement

Investing is an important part of retirement planning. Proper investing includes not only managing growth for the future, but income needs in the present. Our investment plans are integrated with the overall financial plans to ensure retirement dreams are met and risk is limited.

Work with a professional money manger

Managing investments is not an easy do-it-yourself job. When it comes to your nest egg, it's makes sense to hire a professional to get it right.